Get the free balance sheet template fillable

Show details

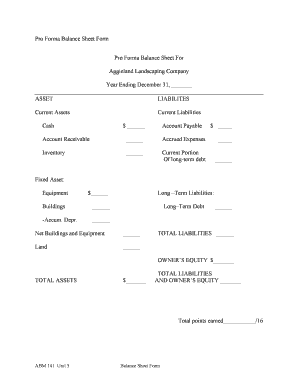

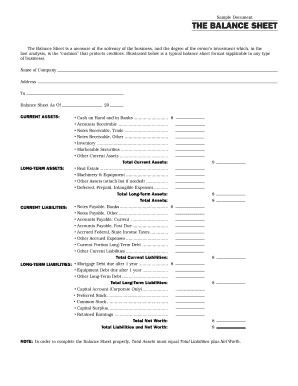

PROJECTED BALANCE SHEET Company Name HistoricalProjectedas of date as of date ASSETS Current Assets Cash in bank$$Accounts receivableInventoryPrepaid expensesOther current assets Total Current Assets$$$Fixed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign projected balance fillable file form

Edit your projected balance sheet file fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your projected balance sheet fillable file form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit template example fillable form online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit balance sheet template fill form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out balance sheet template form

How to fill out Projected Balance Sheet Form

01

Gather all financial data for the projected period.

02

List all assets, starting with current assets followed by non-current assets.

03

Estimate the value of each asset considering future growth or depreciation.

04

Identify and list all liabilities, categorizing them as current or long-term.

05

Estimate the liabilities based on payment schedules and anticipated expenses.

06

Calculate equity by subtracting total liabilities from total assets.

07

Ensure all figures are realistic and supportable with evidence.

08

Revisit and adjust any figures based on financial forecasts or market conditions.

Who needs Projected Balance Sheet Form?

01

Businesses planning for future growth and funding.

02

Investors looking for financial forecasts from potential investments.

03

Banks or lenders assessing loan applications.

04

Financial analysts conducting company valuations.

05

Startups preparing for investor funding.

06

Management teams setting financial benchmarks and goals.

Fill

form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my balance sheet template form directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your balance sheet template form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute balance sheet template form online?

pdfFiller has made it simple to fill out and eSign balance sheet template form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit balance sheet template form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign balance sheet template form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is Projected Balance Sheet Form?

The Projected Balance Sheet Form is a financial statement that estimates an organization's assets, liabilities, and equity at a future date, helping to forecast financial position and performance.

Who is required to file Projected Balance Sheet Form?

Typically, businesses seeking financing or investment, as well as those undergoing certain regulatory compliance, are required to file the Projected Balance Sheet Form.

How to fill out Projected Balance Sheet Form?

To fill out the Projected Balance Sheet Form, list the anticipated assets, liabilities, and equity according to the specified format and guidelines, providing estimated values based on financial projections.

What is the purpose of Projected Balance Sheet Form?

The purpose of the Projected Balance Sheet Form is to provide stakeholders with a forecast of the entity's financial health and stability, aiding in decision-making and strategic planning.

What information must be reported on Projected Balance Sheet Form?

The Projected Balance Sheet Form must report information on current and non-current assets, current and long-term liabilities, and shareholder equity, along with their estimated values for the projected date.

Fill out your balance sheet template form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Balance Sheet Template Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.